42+ when can i stop paying mortgage insurance

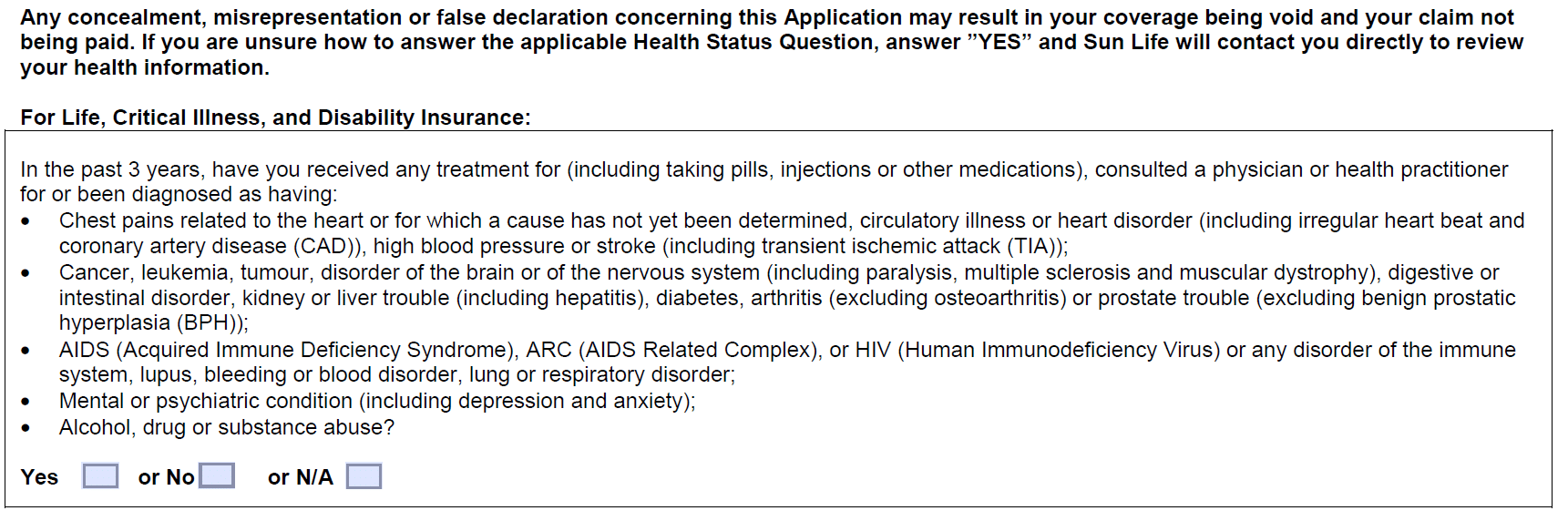

A one-time up-front premium paid at closing or monthly. Web You can typically stop paying for mortgage insurance once your loan is paid down to 78 percent of the original value.

8 Reasons Why Not To Buy Bank Mortgage Insurance Pharma Tax

If you put down at least 10 when you bought the.

. In theory your PMI policy should. Web Lender-Paid Mortgage Insurance And Mortgage Insurance Premiums You can only remove your payments through a refinance if you have LPMI or you have MIP. Web Your mortgage lender must automatically cancel PMI for free when your mortgage balance reaches 78 loan-to-value LTV.

Web To eliminate MIP on mortgages closed between July 1991 and December 2000 you will have to refinance into a new loan. Web Many homebuyers ask FHA if they can stop paying FHA monthly mortgage insurance premiums with their mortgages. This date should have been given to you.

Web July 1991-December 2000. Web When a homebuyer does not have at least a 20 down payment for a house financed by a conventional loan they will likely have to get private mortgage insurance. Web In most cases when you buy a home with a down payment of less than 20 of the purchase price you have to pay private mortgage insurance.

You have two options to pay for PMI. Otherwise well automatically cancel it when your balance is scheduled to reach 78 LTV if youre. Web Ask to cancel your PMI.

Wait for MIP to expire. Web To eliminate the annual mortgage insurance premium MIP on an FHA loan you can either. If your origination date falls between these two markers you cant cancel your FHA mortgage insurance premiums.

If the periodic monthly mortgage. Web Must not have had any 60-day late payments within the last 24 months. In many cases lenders roll PMI into your monthly.

But if you put less than 10 percent down on a loan closed on or after June. Web You have the right to request that your servicer cancel PMI when you have reached the date when the principal balance of your mortgage is scheduled to fall to 80 percent of the original value of your home. For FHA loans applied for between.

Web You can typically stop paying for mortgage insurance once your loan is paid down to 78 percent of the homes original value. In other words once youve paid. In theory it should automatically cancel but.

If your loan has met certain conditions and your loan to original value LTOV ratio falls below 80 you may submit a written request to have your. Timely payments count when it comes to. Web The rule is no payments 30 days late in the past 12 months and no 60-day late payments in the previous 24 months.

Web Paying for PMI. Web If your FHA-appraised value is 250000 and your loan balance is 195000 you can stop paying MIP. Web In order for your mortgage insurance to drop off most lenders require that you cannot have more than one 30 day delinquent payment towards your mortgage in.

Ask Stacy When Can I Stop Paying Mortgage Insurance

How To Get Rid Of Pmi Nerdwallet

When Can Mortgage Insurance Be Dropped

15220 River Rd Germantown Md 20874 Mls Mdmc2084628 Redfin

Which Credit Score Is Most Important Understand Your Scores

When You Can Cancel Private Mortgage Insurance And How To Do It

When Can I Eliminate My Mortgage Insurance Iron Point Mortgage

How To Remove Pmi Moneyunder30

How To End Your Mortgage Pmi Payments Immediately Loanry

8341 Lyndale Ave S Apt 404 Bloomington Mn 55420 Realtor Com

How To Remove Pmi Moneyunder30

Refinance 411 Say Goodbye To Pmi

Pmi When To Cancel And How To Get Money Back

How To Get Rid Of Pmi Nerdwallet

Text Anzeigen Pdf Bei Duepublico Universitat Duisburg Essen

What Is Private Mortgage Insurance Pmi And How To Remove It

How To Get Rid Of A Mortgage Insurance In 2022 Mares Mortgage